The Math

You’ve likely heard of the 4% Rule. It’s a rule of thumb suggesting you can withdraw 4% of your portfolio in year one, and then adjust that dollar amount for inflation every year after, without running out of money for 30 years.

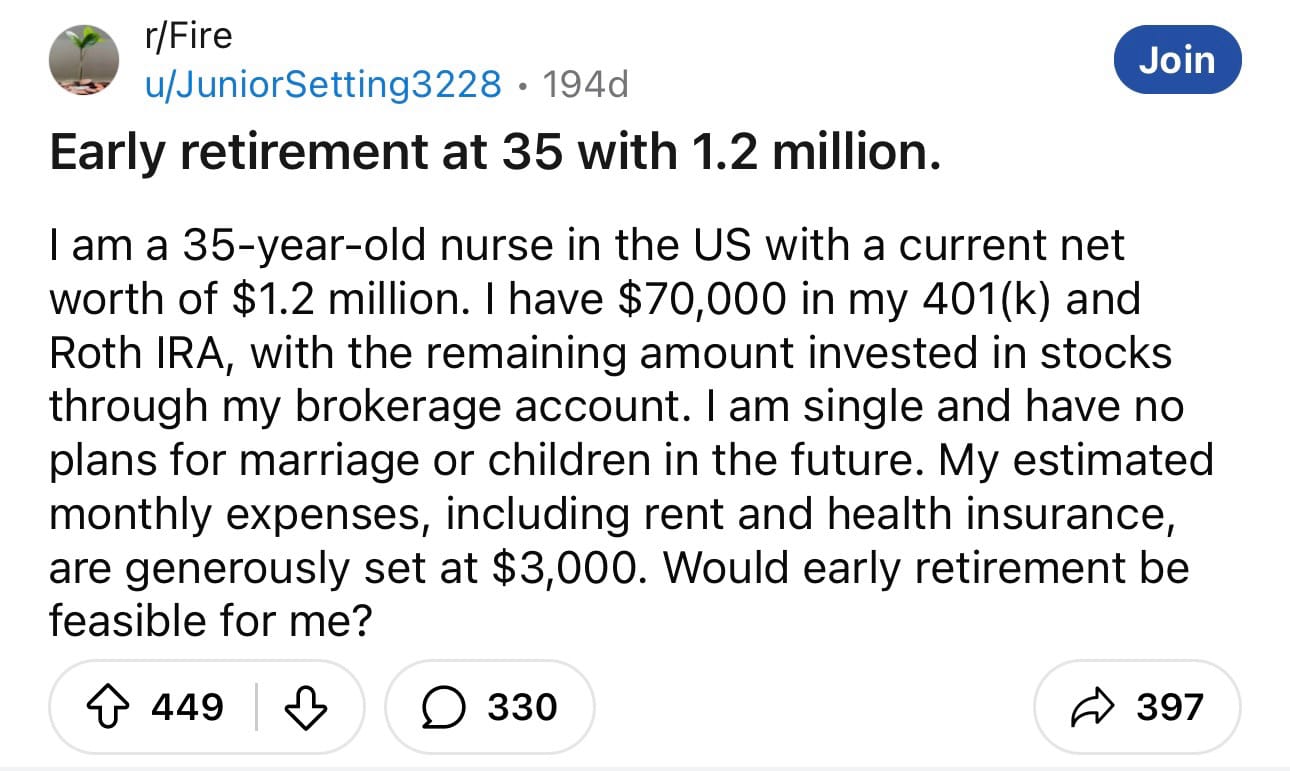

For our nurse, the math looks solid:

Portfolio: $1,200,000

4% Withdrawal: $48,000/year

Annual Expenses: $36,000/year

This leaves a $12,000 annual safety cushion. Even better? Because most of this money is in a brokerage account (not a 401k), they can likely withdraw it for $0 in federal taxes by staying under the capital gains income threshold.

Financially, that’s a green light for retirement.

The Trap

The math works for a standard retirement. But at 35, you aren't planning for a standard 30-year retirement; you are planning for a 50 or 60-year timeline.

The 4% rule was only stress-tested for 30 years. When you stretch that timeline to 60 years, the failure rate creeps up. You have to survive double the inflation cycles and double the market crashes.

If you retire this early, most experts suggest a safer 3.5% withdrawal rate ($42,000/year in this case). The good news? Even at this safer rate, our nurse still covers their expenses.

The Real Challenge

The biggest risk here isn't running out of money—it's running out of purpose.

Retiring at 35 sounds like a dream until Tuesday morning rolls around, all your friends are at work, and you have nothing to do. The "vacation phase" wears off in about six months.

If you are aiming for FIRE (Financial Independence, Retire Early), remember this: You need to retire to something, not just from your job.

You’ve won the money game. Now, go find your purpose.