Okay everybody GATHER ROUND. It’s that part of the economic cycle where we get to play…

BULL MARKET BINGO

Contain your excitement.

Let’s talk about what a bull market is, how to know if you’re in one, and maybe even whether we’re in one right now.

So get your Bingo card ready, and if you aren’t living at a nursing home and don’t HAVE a Bingo card, then just keep reading. The prize is cash, after all.

Okay, first off, what’s a bull market?

These are happy days if you own risky stuff, like stocks and crypto.

A bull market is a period when prices in the stock market (or other markets, like crypto) keep going up over time. Investors are feeling confident, there’s a lot of buying, and overall, the mood is optimistic.

Bull markets usually last for months or even years, and they often happen when the economy is doing well or recovering strongly.

Here’s a good example:

Sounds lovely. What are the ingredients?

There are a ton of things that can drive a bull market in risk assets, but here are five of the most important:

Strong Economic Growth

Think of a strong economy as fuel for the market engine. When the economy is growing, people have jobs, businesses are making money, and consumers are spending. All of this means more profit for companies, which pushes up stock prices. It’s like putting jet fuel in your car – it runs faster (I know nothing about engines, obviously).

Low Interest Rates

Low interest rates are like getting cheap gas for that engine. When borrowing is cheap, companies take loans to grow, and people buy more things – homes, cars, you name it. Stocks start to look better compared to other places you could put your money (like bonds), so investors pile in, boosting the market even more.

High Corporate Earnings

When companies make more money, investors get excited. They start thinking, "Hey, if these companies are doing well now, they’ll probably keep doing well." This keeps optimism high and brings in more buyers. Profits are like a green light saying, “Keep buying – there’s more growth ahead!”

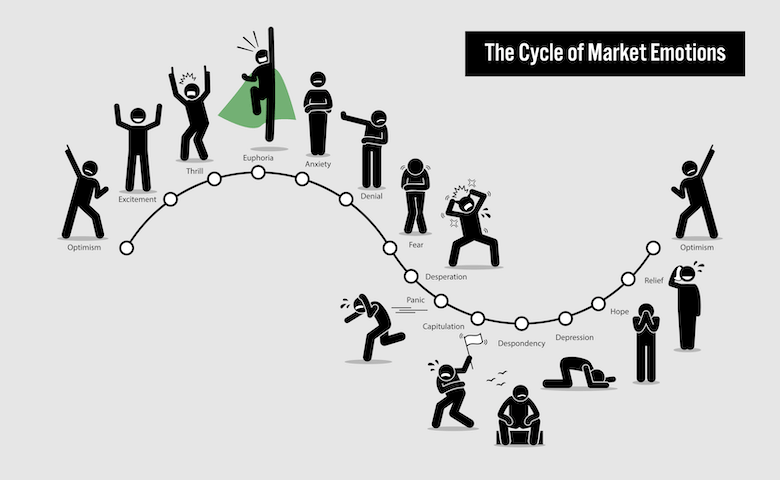

Positive Investor Sentiment

Ever notice how people feel braver when they’re in a group? The stock market works the same way. When investors feel good, they buy more, and that buying drives prices up. It creates a feedback loop where everyone’s excitement just keeps feeding itself. A bull market needs this “good vibes only” energy to keep running.

Market Liquidity and Capital Access

Liquidity is just a fancy way of saying there’s a lot of money sloshing around, ready to jump into the market. Thanks to central banks (think money printers) and investors from all over, there’s a ton of cash in the system. This “liquidity” keeps the market moving – like having plenty of oil in your engine, so it doesn’t seize up.

Great, I’ve got my Bingo card ready

Okay, let’s make this super clear:

Economic Growth | Interest Rates | Corporate Earnings | Investor Sentiment | Market Liquidity |

|---|---|---|---|---|

PRETTY GOOD | GOOD | VERY GOOD | GOOD | GOOD |

Economic Growth - global figures look stable.

Interest Rates - dropping in major economies like the U.S.

Corporate earnings - looking REAL good.

Investor Sentiment - “greed is good”…at least when identifying if you’re in a bull market.

Source: CNN

Market Liquidity - looks like we’re on a long-term upswing.

Bingo?

Wild card: TRUMP

With Trump coming back as President in 2025, there will be some big changes. He wants:

Lower taxes (good for growth, good for stocks)

More tariffs (usually bad for growth, usually bad for stocks)

More oil drilling (good for growth, good for energy stocks)

Deregulation (good for growth, good for stocks)

Who knows how much of this will actually happen. What matters is that right now the market thinks it might.

So…

Bingo?

We can’t say for sure, but it’s looking positive. You’ll know things are really heating up when your Uber driver starts giving you stock tips.

Until then, hold on.