Morning 🤗

Usually we do a top five or a top ten, but today is a bit different…

A TOP 25??

Just kidding, I don’t have that kind of time.

Five very important charts:

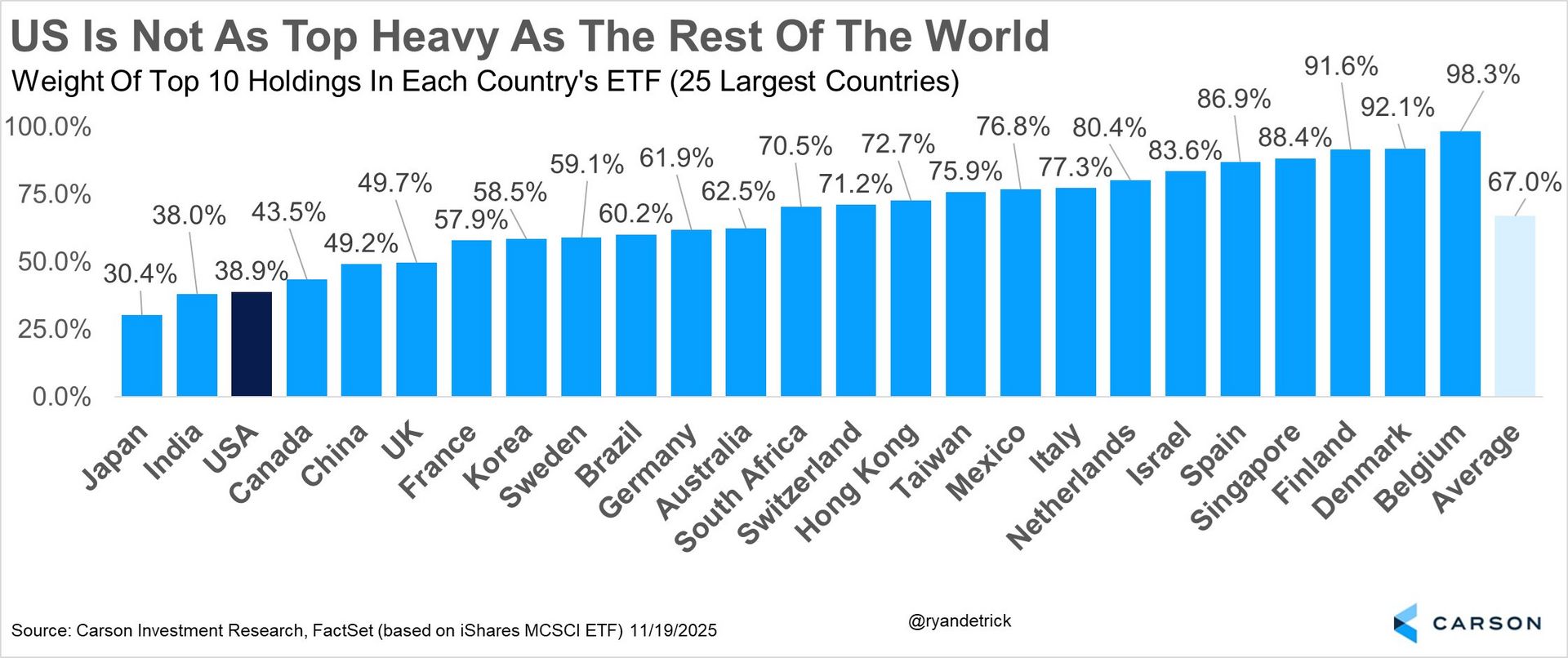

The most important chart you’ll see today:

What does this mean?

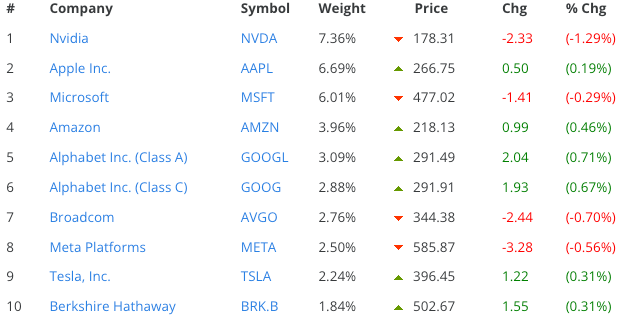

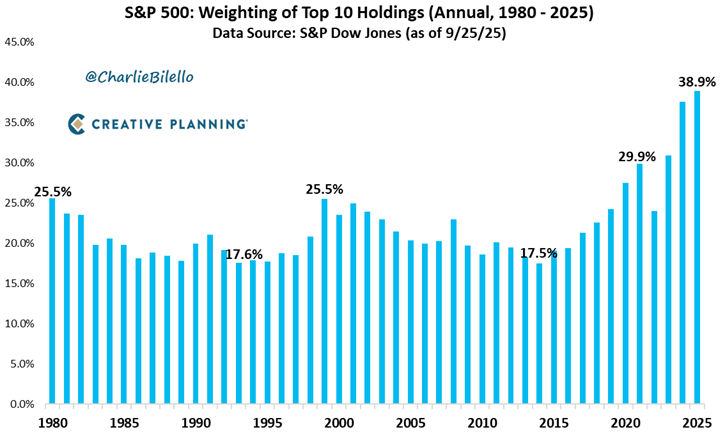

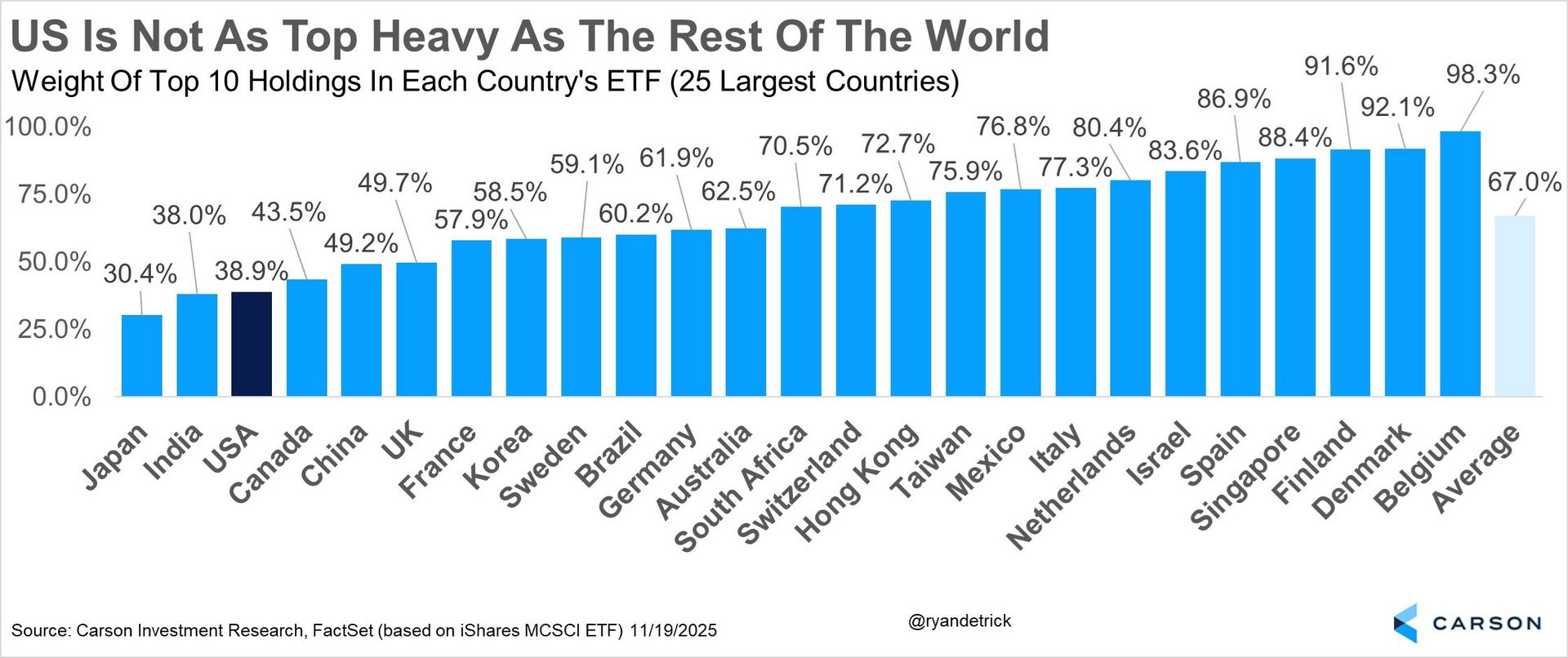

People CONSTANTLY (and I mean constantly) talk about how concentrated the US stock market is, with the big tech stocks taking up a huge portion of the weight of the market; 39% right now:

Who cares?

Well, this is a historic high, signalling that the US stock market is massively concentrated.

People usually view concentration as risk. It’s the old “don’t put all your eggs in one basket”, but with stonks.

Remember that first chart:

Relative to other countries, the U.S. stock market actually isn’t all that concentrated.

But the U.S. is different…

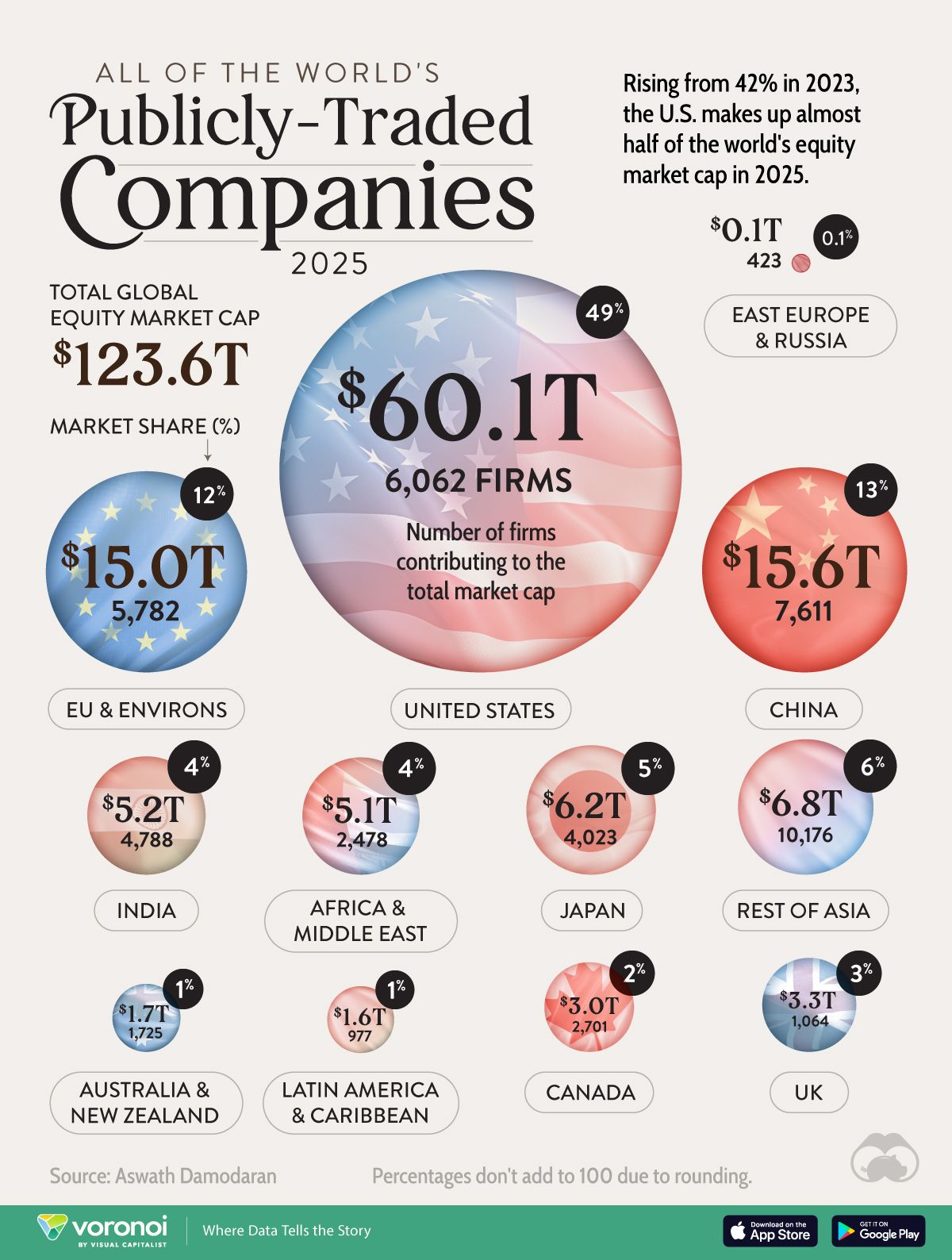

This isn’t an “American Exceptionalism” thesis; this is just pointing out that the U.S. is bigger…much bigger…than other stock markets.

So high historical concentration in this market is PROBABLY more important than high concentration in the Belgian stock market. Because, well, tbh, I didn’t even know Belgium had a stock market.

So what should you do?

Don’t put all your eggs in one basket.

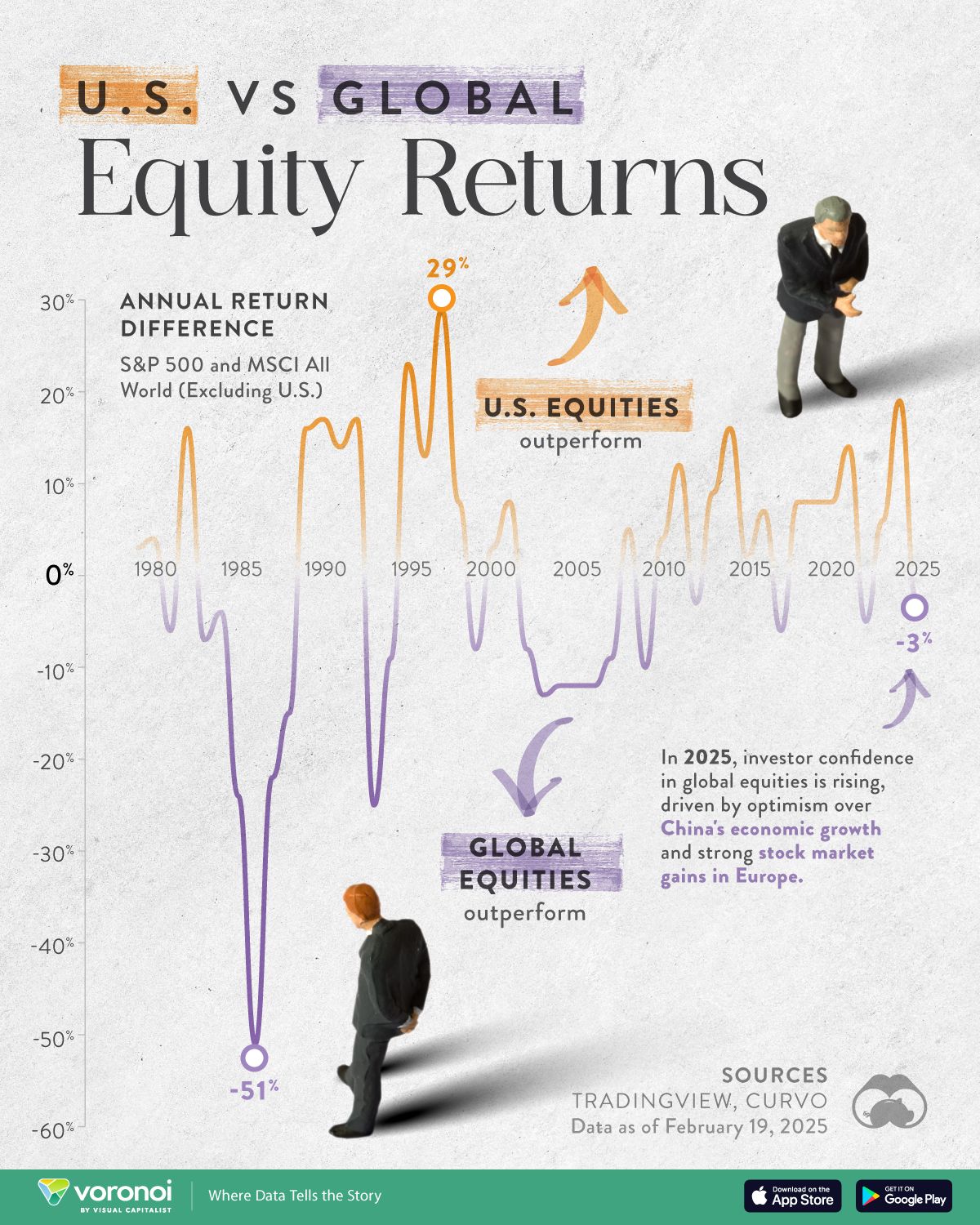

U.S. stocks haven’t always been the top dawg. Concentration does create risk, even if the index isn’t as concentrated as it is in some other countries.

So how do you manage this risk?

Go global - invest in something like Vanguard Total World Stock Index Fund ETF.