If you’ve ever dipped a toe into crypto, you’ve probably noticed one big issue: volatility.

One day FARTCOIN is booming. The next day it’s in freefall. That’s fun for speculators—not so fun if you’re trying to use crypto for anything practical, like payments or savings.

Enter: stablecoins.

Stablecoins are digital currencies that are designed to not swing wildly in price. They’re pegged to real-world assets (usually the U.S. dollar), which means one stablecoin = one dollar, give or take a few fractions of a penny. You get the speed and flexibility of crypto without the chaos.

They’ve become a kind of “bridge” between the wild world of crypto and the more familiar world of traditional finance. Think of them like digital dollars that live on the blockchain.

But how do they work and who cares?

How do they work?

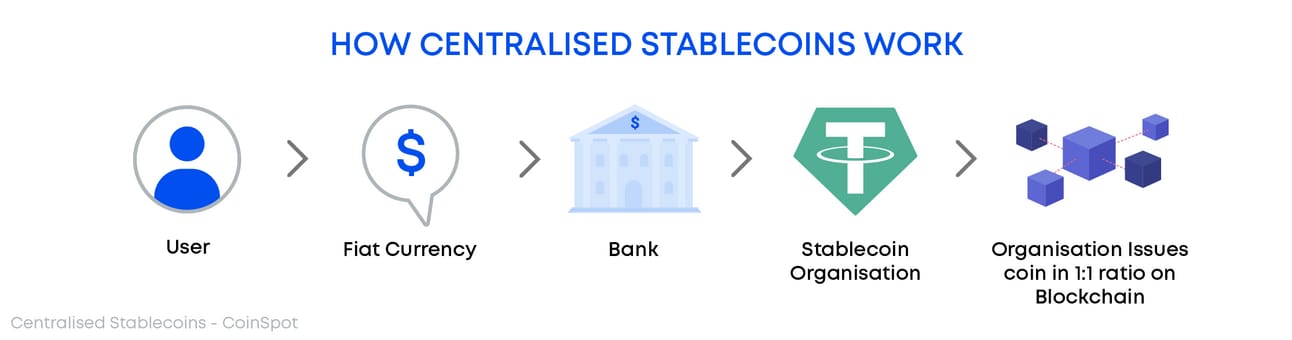

Behind every stablecoin is a stash of assets (cash or short-term Treasuries) sitting in reserve. So when you buy a stablecoin, you’re basically swapping your dollar for a digital version.

If things get dicey and you want out, you can redeem your stablecoin and get your dollar back. That peg (and the ability to redeem it) is what keeps prices stable.

And if the price moves too far off $1? Arbitrage traders step in to profit—and in doing so, pull the price back into line. It’s a surprisingly elegant system…most of the time.

There are three types of stable coins:

Fiat-Backed Stablecoins

These are backed 1:1 by traditional currencies like the U.S. dollar, held in a bank account or other reserve. For every stablecoin issued, there’s real money sitting somewhere to support it.

Collateralized Stablecoins

These are backed by other assets—like crypto or gold—that are locked in smart contracts or vaults. They often require extra collateral to account for the price swings of the backing asset.

Algorithmic Stablecoins

These use code and smart contracts to control supply and demand, keeping the price stable without holding real-world assets. If the price goes above or below $1, the algorithm automatically increases or decreases supply to bring it back in line.

Why should you care?

Because stablecoins are quietly changing how money moves:

Cross-border payments are faster and cheaper (no wire fees or waiting 3 days)

DeFi runs on stablecoins—they’re the fuel for borrowing, lending, and earning yield

Unbanked populations can access digital dollars with just a phone and internet

Stablecoins also open the door to programmable money. Imagine rent that pays itself, payroll that runs instantly, or wills that execute automatically. That’s all possible when dollars live on-chain.

The catch?

Regulation. Governments are (rightfully) asking: who’s backing these coins? Are the reserves real? What happens if there’s a run?

Thankfully, that’s getting sorted out right now.

Most major jurisdictions-including the US, EU, UK, Singapore, and Hong Kong-are finalizing or have enacted stablecoin regulations focused on reserve backing, transparency, and consumer protection. The EU’s MiCA framework is now live, while the US is expected to pass federal stablecoin legislation in 2025, such as the GENIUS Act.

It’s a space to watch—both for its massive potential and the oversight it still needs.

But one thing’s clear: stablecoins aren’t a fad. They’re the infrastructure layer that might just bring crypto to the mainstream.