Can I see the future?

Unfortunately not.

Otherwise I would’ve bought Bitcoin when I was 19, Florida real estate when I was 18, and Nvidia when I was 8.

What I can do is watch these 10 key indicators that have historically been good signs on what’s coming up with the economy.

10. Stock Market Performance

Stocks move based on what people expect to happen in the future.

If people think companies will earn more money, they’ll buy their stock.

So far this year, US stocks have bounced around while international stocks have done much better.

S&P500: the primary US stock market

Non-US stocks have performed way better this year

9. Average Weekly Hours Worked in Manufacturing

Average hours worked indicate demand for labor and can signal future employment trends.

There’s nothing too dramatic happen here. But then again, aren’t the robots supposed to be doing all the manufacturing now?

Crazy dip down in 2020.

8. M2 Money Supply

Usually mo money = mo problems. But when it comes to the economy, mo M2 Money Supply = mo liquidity and stimulation of growth.

M2 money supply is a measure of the money supply that includes physical currency, checking accounts, savings accounts, and other short-term savings vehicles like money market funds and certificates of deposit

This measure has been steeply creeping up recently. Types of investments that do well during times of increasing liquidity are the risky stuff, like Bitcoin.

Number go up?

7. Industrial Production Index

Industrial production measures real output in manufacturing, mining, electric, and gas industries.

It basically measures the change in volume of production. Increasing = good.

Pretty flat for a while now; no major signal.

6. Durable Goods Orders

Durable goods orders measure new orders for manufactured goods intended to last three years or more - stuff like furniture, cars, and appliances.

When this measure is rising, that means a positive outlook for the economy…

…and the US just had its strongest monthly increase on record.

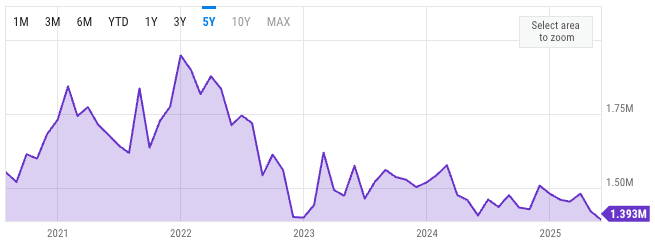

5. Building Permits and Housing Starts

Building permits show what will happen with future real estate supply and construction activity. More = better (generally).

This number is…

…very very low.

Why is it so low? Probably because mortgage rates are still more than 6.5% - about where they were in 2007!

4. Yield Curve (10-year vs. 2-year Treasury Spread)

Okay, this one is pretty technical, I’ll admit it.

The 10-year vs. 2-year Treasury spread is just the difference between the interest paid on long-term and short-term U.S. government IOUs; whether it’s positive or negative gives a quick pulse check on how people feel about the economy’s future.

And right now…

…we’re firmly positive. That’s good!

3. Initial Jobless Claims

Initial jobless claims measure the number of people filing for unemployment benefits for the first time in a given week.

Rising = bad.

Falling = good!

2. Consumer Confidence Index

Consumer confidence measures household sentiment about current business conditions and future economic prospects.

Consumers drive about 70% of the US economy, so this is important! If consumers are confident, they spend more.

Ticking down slightly, and even near 2020 lows! Pretty wild. Still, a long way from 2009.

Before #1….

Try the better way to save, plan, and invest

Do you have big financial goals, but you’re not sure if they’re on track?

Try Fulfilled and make your goals a reality.

✅ SEC-registered

✅ Truly goal-tailored advice

✅ You don’t have to transfer a dollar

For limited time get access to 50% off pricing FOR LIFE!

1. Purchasing Managers’ Index (PMI)

Think of the PMI as a quick monthly “health check-up” for factories. A score above 50 means activity is growing; below 50 signals it’s shrinking. It often moves ahead of official GDP data, so investors and policymakers watch it closely.

At 49, we’re not quite in expansion territory, but it is increasing steadily.

So what does all this mean???

For those keeping score, we have…

5 positive signals: Stock markets, M2, Durable Goods Orders, Yield Curve, Jobless Claims

3 sort of neutral signals: Purchasing Managers’ Index, Industrial Production Index, Average Hours Worked

2 negative signals: Consumer confidence and Building Starts

Therefore…

Who knows? This is all fairy dust…probably.