Fed cuts rates.

Amazon fires 30,000.

Numbers are now words?

PLUS: a special edition of Financial Booster below

Markets

PAST WEEK | YEAR-SO-FAR | |

|---|---|---|

Nasdaq | +0.8% | +23.1% |

S&P500 | -0.1% | +16.6% |

MSCI Emerging Markets | -0.7% | +32.4% |

Bitcoin* | -4.3% | +17.2% |

Ethereum* | -7.3% | +15.5% |

Stock of the week: | +24.6% | +133.6% |

Crypto of the week: | +27.4% | +123.1% |

*Source: CoinGecko.com As of 8:11PM November 2, 2025

World news

Top news stories of the past week

1) Fed Up (but actually down): The US Federal Reserve cut its benchmark interest rate by 0.25 percentage points last week, to a range of 3.75–4.00%, the lowest since 2022. The move was driven mostly by signs of a slowing labor market. Fed Chair Powell said another cut in December isn’t guaranteed, but most analysts expect (read: hope) at least one more by year-end. Why is this good? Lower interest rates means it’s cheaper to borrow money - an economic boost.

US Federal Reserve Chair: Jerome Powell (Papi Powell to his friends)

2) (Severance) Package Delivered: Amazon has announced plans to cut 30,000 corporate jobs, in one of its largest restructuring efforts in years. CEO Andy Jassy said the layoffs aren’t just about reducing costs or replacing roles with AI, but part of a broader effort to, among other things, improve “culture”. Because nothing says ‘strong company culture’ like the looming fear of layoffs.

Look at all that company culture.

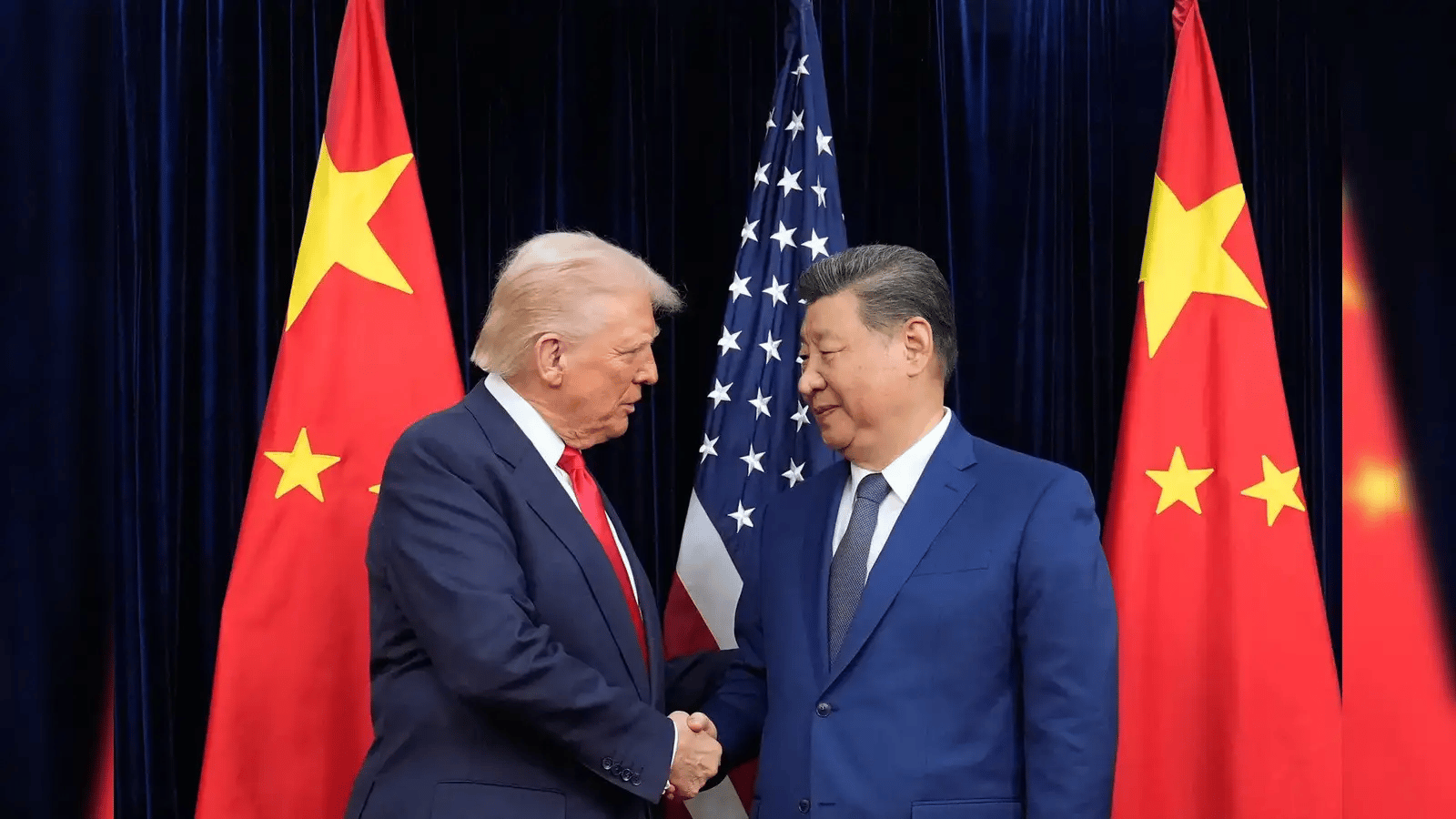

3) Trade Truce: The U.S. and China struck a major new trade agreement aimed at cooling tensions and stabilizing global markets. Under the deal, China will significantly increase its purchases of American agricultural goods and delay planned export controls on rare-earth minerals for at least a year. In return, the U.S. agreed to suspend threats of sweeping 100% tariffs on Chinese imports and to fast-track approvals for tech exports. Looks like Tariffgeddon is pushed back another month folks.

Top WEIRD stories of the past week

1) A refrigerated trailer containing 30 pallets of whipped cream - valued at about $80,000 - was stolen in the early hours from a business in Guelph, Ontario. Do we think this has any connection to the butter heist from last year? Or the maple syrup heist before that? What dessert crime family is running Canada?

2) Maurizio Cattelan - the artist behind the duct-taped banana - is now auctioning an 18-karat gold toilet titled “America,” opening the bid at roughly $10 million. The new East Wing of the White House is about to have a dozen of these.

3) Dictionary.com has named the viral slang 67 (pronounced “six-seven”) as its 2025 Word of the Year - a deliberately undefined expression that exploded in usage among Gen Alpha. So numbers are words now I guess? Someone check on Webster.

Chart

You like charts? Graphs? Ya you do

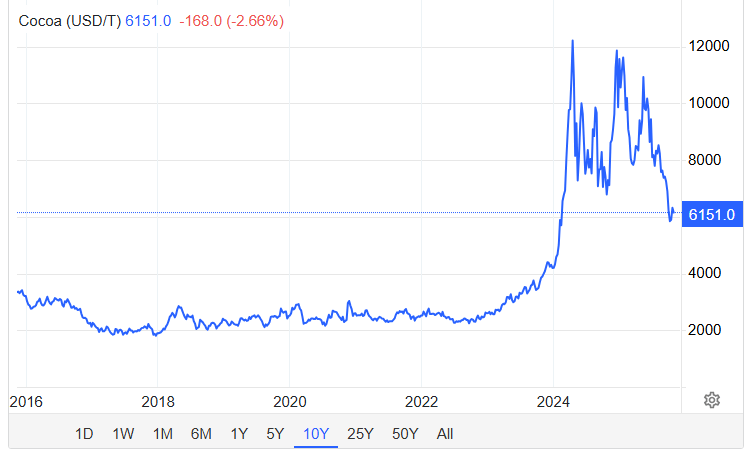

The real scare this Halloween? Chocolate prices. 😱

Global cocoa prices have fallen from their 2024 high, but are still wild, with beans up roughly 3x from their 2023 prices. The insane prices are driven by poor harvests in West Africa (where roughly 70% of the world’s cocoa comes from), drought conditions linked to El Niño, ageing trees, crop disease, and freight costs.

Personal Finance

Financial Booster

Something different today.

The government shutdown is in its sixth week.

Food stamps used by 40 million Americans (SNAP benefits) shut off yesterday.

If you can, give someone else a boost.

Donate to your local food bank - check where that is here:

Find Your Local Food Bank

The Treasury secretary says food benefits could restart by Wednesday, but nobody knows for sure.

COMPOUND INTERESTS EFFORT:

For every person you refer this newsletter to today, we’ll donate a dollar to Feeding America.

Let’s help, together.

Music

Banger of the week

Most important thing

Meme? Nah. Art.