There are 24 hours in the day and the average American spends…

8.5 hours sleeping

8 hours working

2 hours watching Survivor re-runs

1.5 hours eating/cooking

1 hour commuting

and 3 hours replaying lost arguments in their head

Soooo when are we supposed to find the time to get on top of our finances? No wonder 72% of Americans report feeling stressed about money.

No need to worry. We’ve got a five step checklist to bring you financial peace of mind.

Follow these steps IN ORDER and you’ll go from anxious about your assets to confident about your cash in no time.

Feel like flipping through some funny pictures and less text instead? Here’s the whole guide in a FREE PDF:

Also some funny pictures below though…

1. Optimize your spending

Too obvious? Tracking your spending helps you uncover areas to save money without feeling the FOMO.

Steps:

Sort your spending from last month by needs (rent, groceries, insurance) vs. wants (dining out, partying, O.F.).

See where you’re spending too much. This might be obvious (Uber Black for every trip) or less obvious (subscriptions you don’t actually use adding up). Do your best to highlight your wants and cut them down.

Make this easy by making it automatic; start tracking your spending with a budgeting app like YNAB (not sponsored).

If you don’t want to use a budgeting app, focus on the 50/30/20 rule: allocate your money by 50% for needs, 30% for wants, and 20% for savings.

2. Build an emergency fund

Life can throw you a curve ball. But if you have some cash saved up for emergencies, that really takes a load off. The general rule of thumb is to save between 3-6 months of expenses.

Steps:

Open a high-yield savings account or find a money market ETF like iShares Premium Money Market ETF (slightly higher interest rate usually).

Calculate your regular monthly expenses.

Multiply your monthly expenses by between 3 and 6. You can save more if you want, but 3 months is the bare minimum. It all depends how much big of a cushion you want. This number is your target.

Set-up an automatic transfer from each pay-check to the savings account or ETF.

Cut it off when you hit your target.

Pro tip! If you want an easy way to calculate this, refer one person to this newsletter with the link at the bottom and we’ll send you an emergency fund calculator along with the retirement calculator!

Now you’ve got a safety net! That’ll give you this level of confidence:

3. Pay off expensive debt

Debt can be a serious anchor on your financial well-being, especially when it charges a high interest rate. Credit cards are usually the biggest culprits here. Paying them off is a big step on getting to financial peace of mind.

Steps:

Find all your debt charging an interest rate above 8.5%, credit cards first.

Focus on paying off your debt that changes the highest interest rate first.

If you have a few debts, transfer your debt balances to the loan with the lowest rate to save on interest costs.

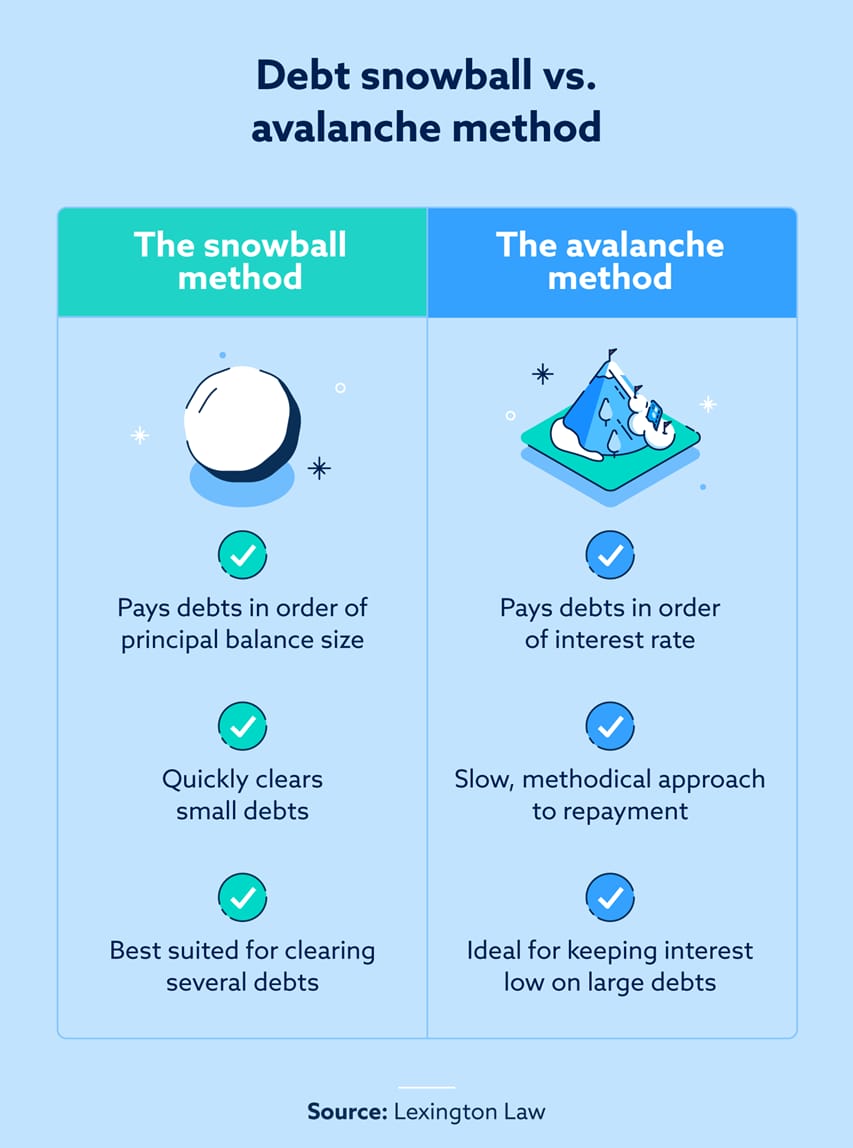

Pro tip! Use the avalanche method:

4. Use employer benefits

Bosses aren’t all bad, sometimes they give you free money! Lots of employers offer 401(k) matching of your contributions, soooo use them!

Steps:

Ask your employer if they offer 401(k) matching.

If they do (great success) fill out the required forms to set that up (it’s easy).

If they don’t, rally together your fellow employees and

revoltask your employer to start! It’s a very common benefit.

Pro tip! This really adds up. A 5% match if you’re making $75k/year could grow to $450,000 if invested over 30 years!

5. Start investing regularly

It is never too early to start investing for the future. Whether it’s for your kid’s college education or your retirement, investing can help you get there easier.

Steps:

Look at your income and expenses; how much can you save each month? Don’t forget about the emergency fund you’re saving for or debt you’re paying off too.

Open an investing account with your bank or an online service like Robinhood.

Understanding how much you can save each month, start investing whatever amount feels comfortable.

If you get a raise or bonus, don’t increase your lifestyle, increase your investing first!

Not sure what to invest in?

If you want your money to be stable, check out iShares Core Conservative Allocation ETF

If you want some growth and are ok that your money might go down sometimes, check out iShares Core Growth Allocation ETF

If you’re ok with big drops in your money in exchange for the chance of higher long-term returns, check out Vanguard Total World Stock ETF

Does it feel like I just water-boarded you?

With information, that is.

Well as luck would have it, here’s that PDF I mentioned which you can keep handy for free! It even has a bonus step in there to help you find financial peace of mind.

So if you’re finding it hard to manage your finances between commuting, Survivor Season 9, and replaying that fight with your co-worker 3 years ago…this will help!