As the international evil villain and Dutchman, Goldmember, once said:

“I love gold.”

He should have added “…and silver.”

The two precious metals have gone absolutely insane over the last 12 months.

Gold is up 67% and silver is up 164%.

They are now the two most valuable assets in the world - literally gold and silver.

But why are they up so much and what happens next?

International unease

The year started with a bang. In early January, U.S. forces went into Venezuela and captured their leader, Nicolás Maduro.

Imagine you are at a crowded park and a fight breaks out. What do you do? You grab your bag and move to a safe spot (probably start filming too). Investors do the same thing.

When big countries start fighting, investors get scared. They don't want to hold "paper money" that might lose value. They want things they can hold in their hands.

Gold jumped 3% in one day. That might not sound like a lot, but in the world of big banks, that is a massive "scary" signal.

The $38 trillion problem

While the news is focused on Venezuela, there is a much bigger problem at home. The U.S. government now owes $38 trillion.

If that sounds like a lot, it’s because it is.

Think of it like a giant credit card bill that never gets paid off. To pay the interest on that bill, the government has to print more money. When there is too much money floating around, each dollar becomes worth a little bit less.

This is called debasement.

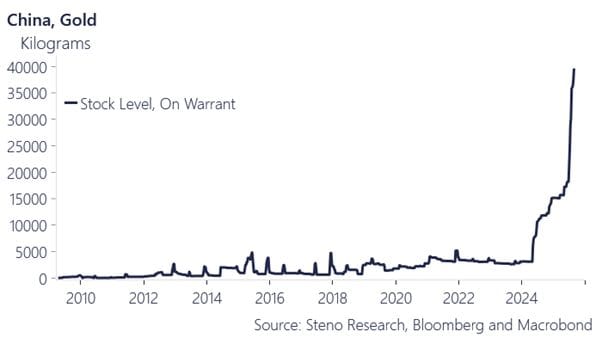

Big players, like the central banks of China and Poland, see this coming. They are trading their U.S. dollars for gold bars. They want "insurance" in case the dollar loses its power.

Silver’s all solar…for now

Silver is even crazier than gold right now. It has two "jobs":

It’s a "safe" metal like gold.

It’s used to build things, like solar panels - which China is making a ton of.

Right now, there is a huge shortage. Mexico and Peru (where most silver comes from) are having trouble digging it out of the ground. Because there isn't enough to go around, the price has shot up.

But there’s a catch.

A giant solar company called LONGi just figured out how to use copper instead of silver to make solar panels. Copper is way cheaper.

If every company switches to copper, silver might lose its "cool factor" in the tech world. It’s a battle between "we don't have enough" and "we might not need it anymore."

Is this a bubble?

People often ask if this is like 1980, when silver prices crashed and burned.

Back then, one super-rich family (the Hunt Brothers) tried to buy all the silver in the world to control the price. Today is different. It’s not just one family; it’s entire countries and giant pension funds buying in.

Gold is now seen as "Sleep Insurance." People buy it so they don't have to worry about the government's debt.

Silver is the "Wild Child." It could go to $100, or it could drop if that copper technology takes over.

The bottom line

You don't need to go out and buy a chest of gold coins today. But the world is moving away from trusting just "paper" and moving toward "hard assets."

In a world that feels a bit broken, having a clear plan for your money is the only way to stay "Fulfilled."

What do you think? Are you a "Gold Bug" (like our pal Goldmember) or do you think the dollar is still king? Reply and let me know!