Remember how in 2021, buying houses was, like, really super hella cool?

Not so much anymore.

New home sales haven’t been this low since 1995.

Does that mean the economy is crashing down and the stock market along with it and we’re all going to die?

Not so fast on the first two and if Bryan Johnson has his way, maybe not the third either?

Let start with the mortgage

Buying a house is always an expensive affair, but today especially.

The cost of borrowing money to buy a house in the U.S., hasn’t been this high in nearly 20 years:

Why are mortgage rates so high?

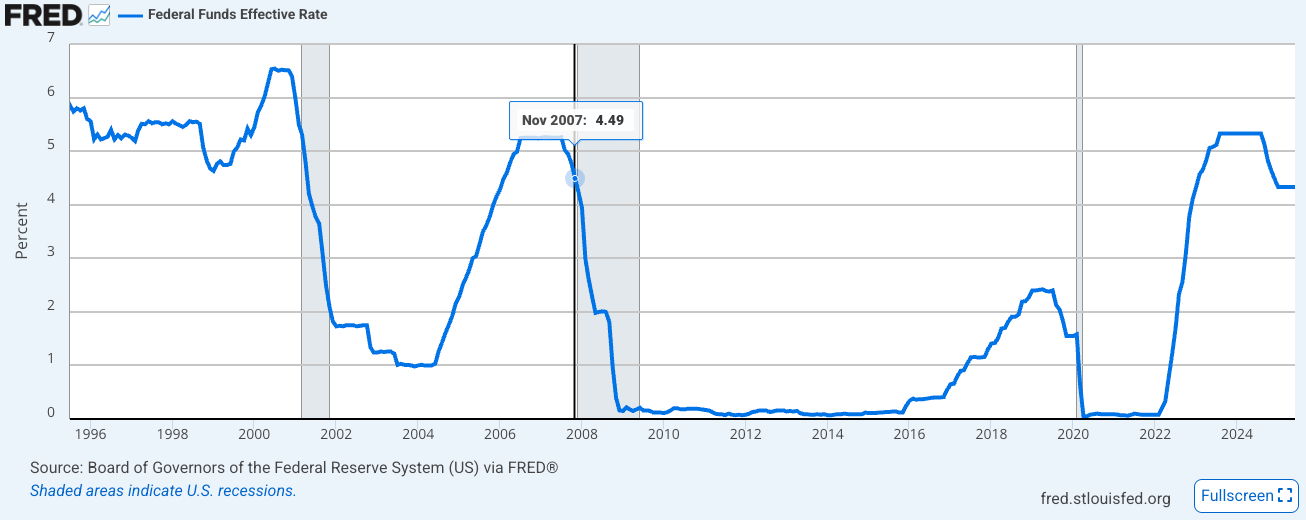

Because the main thing that impacts mortgage rates is the rate which the U.S. central bank (known as the Federal Reserve), is willing to lend money TO banks.

Their rate has been coming down, but not quickly:

When the central bank rate is high, mortgage rates are high - banks want to make a profit on the money they lend you!

So mortgage rates are high - so what?

People aren’t buying houses. The rate of new homes being built has fallen to levels not seen since the depths of COVID.

So why doesn’t the central bank lower rates?

The central bank has two jobs:

Keep unemployment low (which it is). If unemployment spikes they drop rates.

Keep inflation below 2% (which it isn’t). Until it goes below 2%, they’re unlikely to drop rates.

So is this good or bad?

Depends who you ask.

For a young couple who wants to buy a new home: bad. The high borrowing costs and low amount homes on the market means their options are slim.

But for someone who owns stocks: good…surprisingly.

Stock markets are at all-time-highs:

U.S. Stock Market

Global stock market

Wait…I thought low rates boost stocks?

Holy f**king sh*t this person’s smart.

Sorry for the language, mom!!!

You’re right. USUALLY low rates makes boring cheap, which brings more money into the economy, which boost stocks.

But there’s more going on.

Companies are earning a lot of money

The amount of money companies earn has been steadily increasing. It’s not quite at all time highs, but investors clearly expect it to get there.

Lots going on here; it’s earnings of global companies. Just know higher bars = good.

Why are companies earning so much?

Don’t make me say it.

I’m going to say it.

ARTIFICIAL INTELLIGENCE.

Ever heard of it?

AI is bringing in huge efficiency gains for companies and expected to keep doing so as its adoption accelerates.

That’s it?

Not quite.

Stocks are also at all time highs the amount of money sloshing around the global economy (also known as the M2 Money Supply or global liquidity).

The more money there is in the system, the more money there is to do business.

So should I panic or not?

Huh. You sound like me when my mom reads this and calls me telling me she read today’s newsletter and doesn’t approve of my language.

For now, no need to panic.

Global liquidity is increasing, AI is enhancing efficiency, and stocks (for now) keep climbing.

Mortgage rates may be high and it’s definitely not a great time to buy a house, but hey, FARTCOIN isn’t far off all-time-highs, so someone out there is happy.