Have you ever gone over budget on a kitchen remodel? It hurts, but usually, the FBI doesn’t get involved.

Unless, apparently, you are the most powerful economist in the world.

Imagine this, but the FBI is reading you your Miranda rights.

For the first time in American history, a sitting Federal Reserve Chair is under criminal investigation. Federal prosecutors have opened an inquiry into Jerome Powell.

The official reason? Prosecutors are looking into whether he misled Congress about the cost of renovations to the Fed’s headquarters in Washington.

The unofficial reason? Well, that’s where things get interesting.

The HGTV Defense

On paper, this is about drywall and marble. Prosecutors are investigating whether Powell lied about the price tag of a massive refurbishment of the Fed’s main building. The Department of Justice has already served grand jury subpoenas, compelling documents and testimony.

How much was the overrun? About 30-35%. Sounds like a usual construction overrun to me tbh.

If this sounds like a technicality to you, you aren’t alone. Markets, lawyers, and insiders view this renovation probe as a "Trojan Horse."

Nice, I’m reading the Iliad right now. This outta be good.

The Real Fight

Powell has called the investigation “unprecedented” and claims it is part of a broader campaign of threats from the White House.

President Trump has spent years attacking Powell for refusing to cut interest rates as aggressively as the administration wanted. Now, reporting indicates this probe was approved by leadership closely aligned with the President.

Trump even sent Powell a hand-written note last year demanding ultra-low interest rates. The President is passing notes in class!!!

“Jerome, please drop rates more or I won’t play with you at recess.”

Think of the Fed Chair like a referee in the Super Bowl. Their job is to keep the game fair (control inflation), not to help one team win (juice the economy before an election). If the coach can fire the referee (or threaten them with jail time) the game loses all integrity.

Why This Hits Your Wallet

You might not care about Fed office furniture, but you should care about Fed independence. If investors believe the Fed is making decisions based on politics rather than data, two things happen:

Inflation Risk: Politicians almost always want "easy money" (low rates). If they force the Fed to print money when they shouldn't, inflation comes roaring back.

The Dollar Tanks: The U.S. dollar is the world’s reserve currency because people trust the Fed is independent. If that trust breaks, fewer people will want to use U.S. dollars, and it will fall in value.

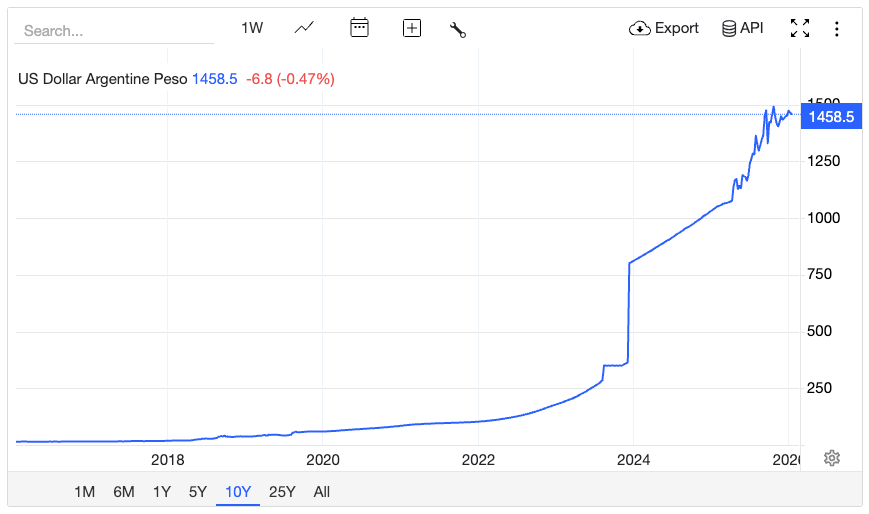

Argentina doesn’t have an independent central bank - look what happened to their currency:

One of the few cases where up and to the right is bad on a chart.

The Bottom Line

If Powell is indicted, he isn't legally required to resign, but the pressure would be huge. A forced exit could shock markets and cause a spike in volatility.

Would this send stocks up or down? Hard to say. A Trump-friendly Federal Reserve Chair would lower rates and juice markets short-term (likely), but investors could be more concerned about the long-term negative impacts of a Fed Chair who’s more concerned about his pal in the White House than the American economy.

While Washington fights over who picked the expensive drapes, the real story is about who controls the value of the money in your pocket.

In a world where the "referee" might be compromised, having a personalized financial plan isn't a luxury, it's a necessity.

Try building yours for free in minutes, at Fulfilled.