Is it just me, or is everything more expensive these days?

That nagging feeling about where prices (and your paycheck) are headed is part of something called consumer confidence.

It is not just you (or me (or us)); consumer confidence has fallen off a cliff.

So what is consumer confidence and why should you care?

What is consumer confidence?

Consumer confidence is how the average person feels about the economy’s current state and its future prospects.

It measures whether we think we’ll have enough money to keep up with bills, snag that occasional treat (see below) and still stash something away for later.

When we’re feeling good, we tend to spend more; when we’re worried, we tighten our belts. Since consumer spending drives a huge chunk of economic activity, consumer confidence can either power the economy forward or tap the brakes, depending on which way it’s swinging.

Occasional treat

COOL so what?

Right now, consumer confidence isn’t just dipping—it’s practically nose-diving. In March 2025, the Conference Board’s Consumer Confidence Index dropped to 92.9, its lowest mark since January 2021.

That might sound like just another statistic, but here’s why it matters: the farther this index falls, the more likely people are to freeze up on big purchases—cars, home renovations, dream vacations, and those fancy electronics you swore you “really needed.”

I really need it!

Once that happens, businesses start worrying about future sales, and before you know it, they’re cutting back on hiring or scaling down new projects. If this downward spiral continues for too long, it can lead to a full-on recession.

That is not so Raven. Why the slump?

First up is inflation. While it has been cooling relative to a few years ago, that doesn’t mean things have gotten cheaper, it just means things aren’t increasing in price as quickly.

Next, there’s the unpredictability of trade policies: new tariffs or sudden trade shifts can crank up prices for imported goods.

This shows just how much people are searching for/concerned about tariffs.

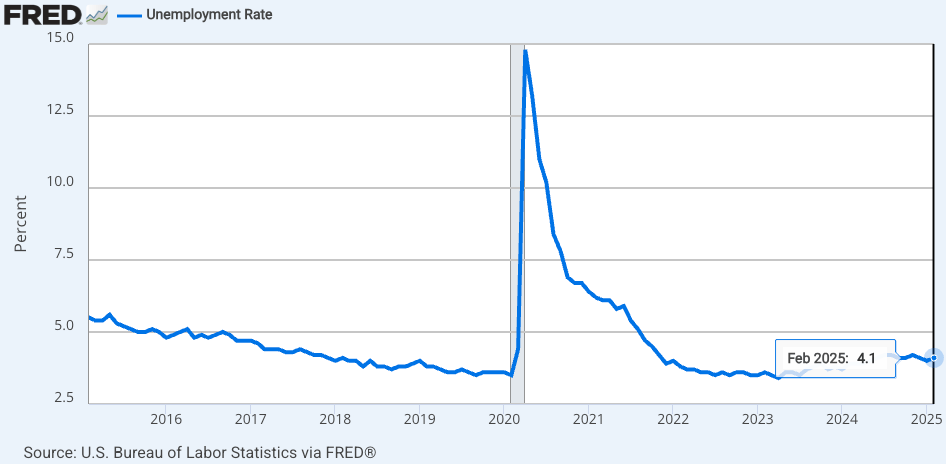

Even the job market—despite a decent unemployment rate—has folks feeling nervous about what lies ahead.

It’s low, but risen slightly from 2023

Has this anxiety already hit the economy?

*checks fridge to see it only contains mustard*

Yes.

Some areas, like high-end fitness equipment and big-ticket gaming consoles, are seeing drops in sales - down 28% and 11% respectively since 2021.

But at the same time, people remain surprisingly eager to splurge on experiences like travel and entertainment—maybe because everyone’s thinking “treat yourself” before things get worse. Though that could just be a US thing - 58% of Americans say they’d rather spend money on experiences (14% higher than the global average).

At the same time, buy-now-pay-later services are on the rise, which might buy consumers short-term relief but can spell trouble down the road if monthly payments start piling up.

What can we do?

It’s a fine line. Central banks and governments have a tough job in front of them.

If they lower interest rates to boost spending, they risk stoking inflation further. But if they keep rates high, consumers may tighten their budgets even more, pushing the economy closer to a downturn. But the expectation is to drop interest rates:

Interest rates are 4.33% right now and central banks think they’ll by down to 3.1% by 2027

Investors, sensing this tension, are bracing for potential ups and downs in the stock market. Volatility did pick up a bit (as measured by the major volatility index: VIX), but it’s fallen back down recently:

Should I be concerned?

Listen, if I panicked every time I saw a negative economic prediction, I would have even more grey hair than I already do (right now I’m like George Clooney from Batman minus the handsome).

That being said…consumer confidence is like the economy’s mood ring. When it’s up, people spend, businesses grow, and the market thrives. When it’s down, wallets snap shut and clouds gather over the economic horizon. Ominous. Moody. Chic.

The best move for everyday folks? Keep an eye on your budget, bolster your savings, and stay flexible. That way, no matter where the confidence meter heads next, you’ll be ready to roll with the punches—and maybe still treat yourself once in a while to one of these: