Did you know that dogs sniff with their left nostril for pleasant smells and their right for potentially dangerous ones? Noses are weird. Humans’ noses switch the dominant nostril once every two to eight hours.

Was this related or relevant at all? Well, my nose is kind of stuffed up when writing this so sure, whatever.

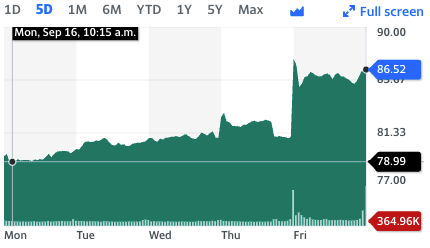

Markets

PAST WEEK | YEAR-TO-DATE | |

|---|---|---|

Nasdaq | +2.4% | +19.8% |

S&P500 | +1.6% | +20.2% |

MSCI Emerging Markets | +1.8% | +9.9% |

Bitcoin* | +7.1% | +49.3% |

Ethereum* | +9.8% | +10.1% |

Stock of the week: | +13.4% | -26.7% |

Crypto of the week: | +52.0% | +56.8% |

Source: CoinGecko.com As of 6:59PM September 22, 2024

World news

Top news stories of the past week

1) Fed cuts rates: The U.S. Federal Reserve, America’s central bank, just cut rates for the first time since 2020, and it was a doozy. With a 0.5% drop in rates, the Fed is working to discourage (slightly) rising unemployment. They’ve been waiting for higher rates to tame inflation, which they believe is “job done” now.

2) TD CEO out: TD Bank, one of the largest banks in North America, just announced their CEO, Bharat Masrani, will retire next year amid their ongoing money laundering scandal. TD was caught earlier this year laundering hundreds of millions of dollars for Chinese drug dealers. The fallout is still happening, with fines and potential business operation restrictions on the horizon.

3) Intel/Qualcomm deal: Qualcomm has recently approached Intel to explore a potential takeover of the struggling chipmaker, according to inside sources. While Intel's stock price surged following the news, a deal is far from certain due to potential regulatory scrutiny and the significant size of such an acquisition, as Qualcomm's market capitalization is about twice that of Intel's

Top WEIRD stories of the past week

1) Two people, one just a teenager, took a subway train for a joyride in NYC. Let’s be honest, there are cooler things to take for a joyride than public transit.

2) In this week’s edition of “why is that a world record” someone set a record for punching 600 balloons in one minute. There are more important things to do.

3) What do you do if you own a zoo and want to do a panda exhibit but can’t get pandas? Paint dogs to look like them!

Chart

You like charts? Graphs? Ya you do

Nike stock shot up almost 10% this week after announcing that Elliott Hill will be taking over as CEO. He worked his way up from intern to the top job over 30 years.

Investment idea

What are we investing in?

Preferred shares

Preferred shares are a type of stock that combines features of both common stocks and bonds. They typically offer fixed dividend payments, which are paid out before dividends on common shares, giving them priority in the company's income distribution.

Preferred shares usually don't come with voting rights, but they have a higher claim on the company's assets than common shares. Preferred shares are interesting because they generally have higher and more stable dividend yields compared to common stocks, as well as lower volatility.

They're particularly good investments during periods of falling interest rates (like right now) because their fixed dividend payments become more valuable relative to the declining yields of bonds and savings accounts. Additionally, preferred shares can offer tax advantages for some investors, as their dividends may be taxed at a lower rate than bond interest.

So how can you invest in them? Let’s keep it easy; here are a couple ETFs that fit the bill:

Invesco Preferred ETF (5.45% yield on this one!)

Music

Banger of the week

Most important thing

Meme? Nah. Art.