Most people try to start investing at the finish line.

They open an app, look at a ticker symbol, and ask, "Should I buy this?"

It’s natural! We want to see our money grow immediately. But investing without a plan is like trying to put a roof on a house before you’ve poured the foundation. It might look okay for a moment, but the first storm will knock it down.

It’s a no bed no bath (or all bath, can’t tell) with infinite sqf. $9M on Zillo

Real wealth isn't built on picking the right stock. It’s built on the right Order of Operations.

If you want to move from financial stress to financial clarity, you need to follow this method:

1. The Diagnostic (Budgeting)

Before you can grow your wealth, you have to define your capacity. This isn't about guilt-tripping yourself over a latte. It is about simple math: (Income) - (Expenses) = Investable Surplus.

This surplus is your raw fuel. You cannot invest what you do not have.

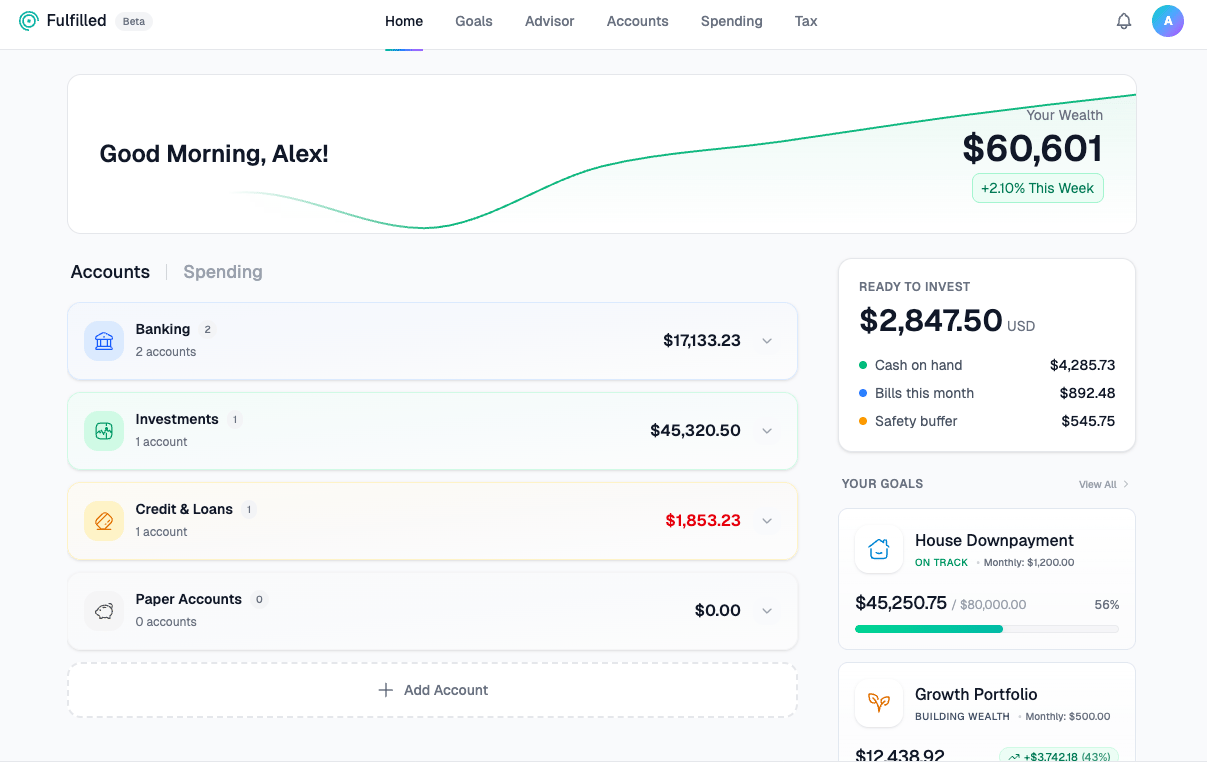

Use an easy app like Fulfilled to automate your budget completely and figure out how much you CAN invest.

2. The Safety Net (Protection)

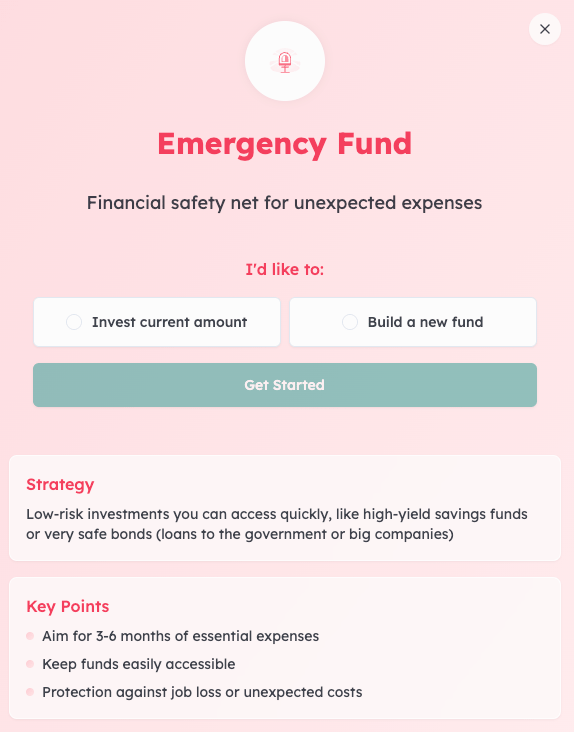

This is the step most people skip. Before you look at the stock market, look at your balance sheet.

Kill the parasites: If you have credit card debt at 22%+ interest (the average in the US), paying that off is a guaranteed 20% return. No stock can promise you that.

Build the moat: Keep 3–6 months of expenses in cash. This is your Emergency Fund and it ensures you never have to sell your investments at a loss just to fix a flat tire.

This security is critical. Want an emergency fund with the best rate on the market? Check Fulfilled.

3. The Architecture (Planning)

HOT TAKE.

Money is just a tool.

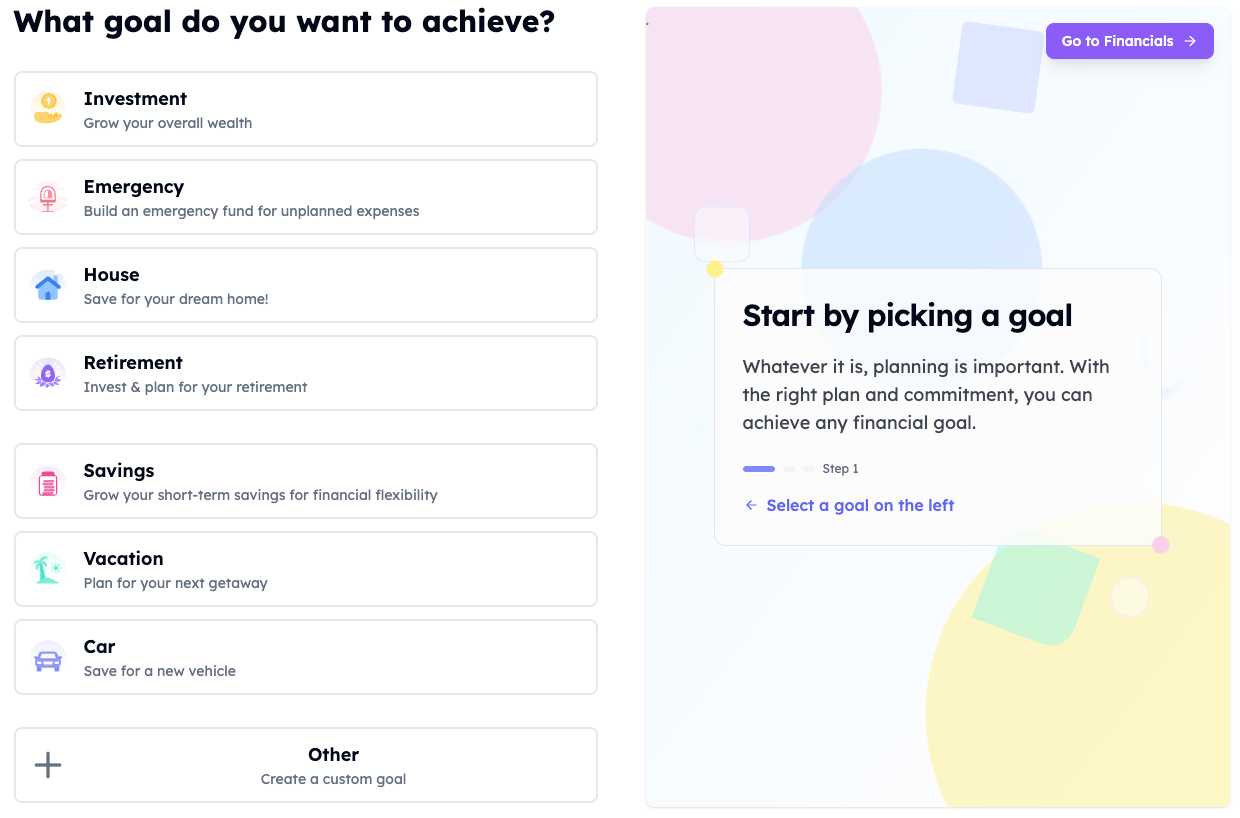

A down payment on a home in 3 years requires a completely different strategy than retirement in 30 years. You need to map your goals before you map your portfolio.

This makes sure that you can ACTUALLY achieve them.

You can map out all your goals in Fulfilled.

4. The Execution (Investing)

Now (and only now) do we talk about investing.

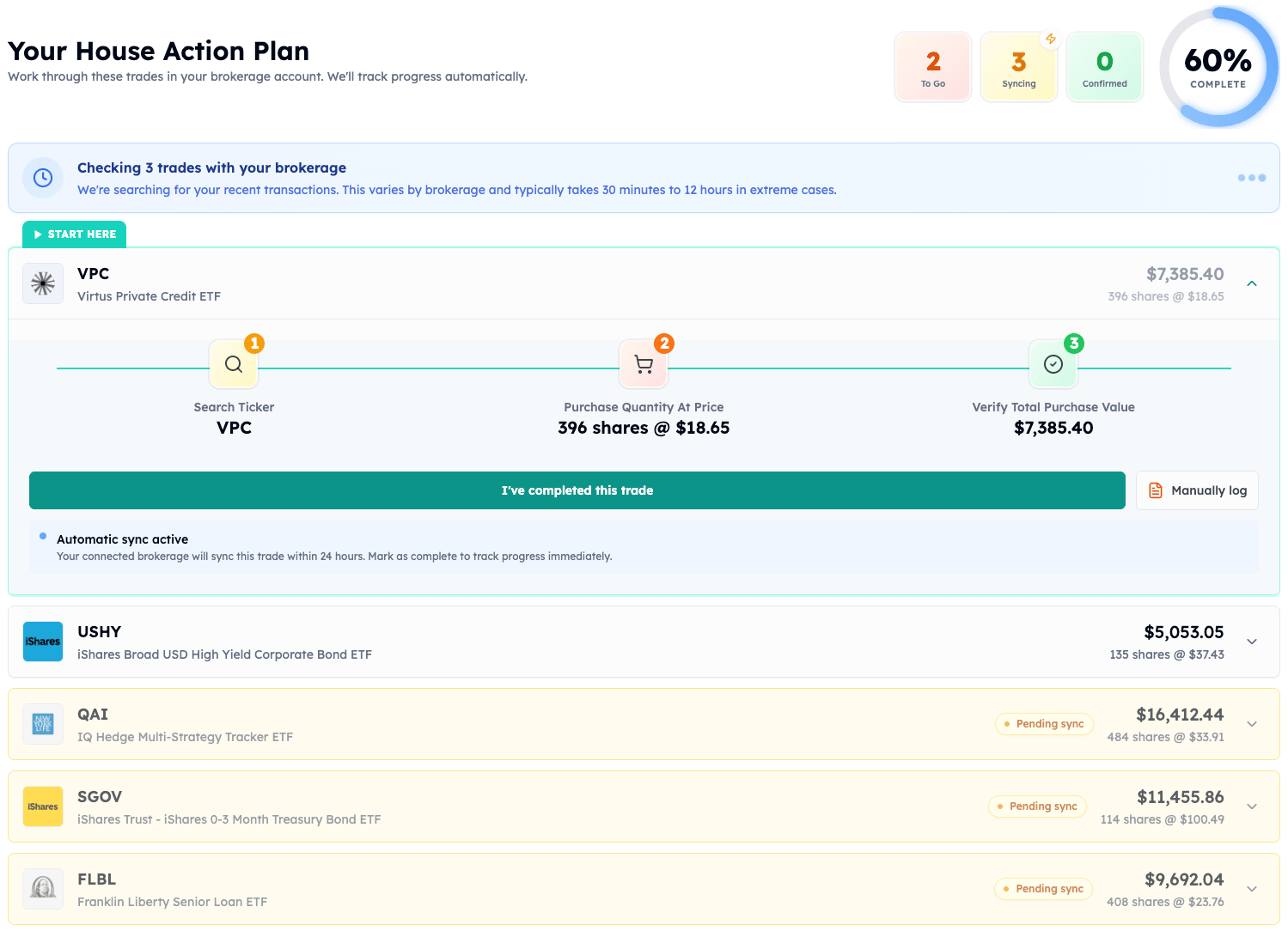

When you’ve done the first three steps, investing stops being gambling. You aren't guessing; you are matching your money to your timeline. You are buying specific investments to solve specific problems in your future.

And when you do invest, don’t do it blindly. Build a portfolio completely tailored to your goals so you can be confident they’re on track.

Guess what? Fulfilled does that too.

The Takeaway

The smartest investors investors don't "play" the market, and neither should you. They build a foundation, define a goal, and execute a plan.

And you can do the whole thing in Fulfilled. Try it out for free.