People love shopping.

NATO shouldn’t love Russian oil.

A snail heist?

Markets

PAST WEEK | YEAR-SO-FAR | |

|---|---|---|

Nasdaq | +5.4% | +21.2% |

S&P500 | +4.3% | +16.7% |

MSCI Emerging Markets | +3.0% | +30.1% |

Bitcoin* | +3.1% | -3.3% |

Ethereum* | +5.8% | -10.3% |

Stock of the week: | +56.5% | +75.1% |

Crypto of the week: | +101.7% | +182.9% |

*Source: CoinGecko.com As of 7:00PM November 30, 2025

World news

Top news stories of the past week

1) Black Friday blitz: U.S. online shoppers spent a record US$11.8 billion on Black Friday 2025 - up 9.1% from last year - as more people turned to e-commerce for holiday deals. Much of the surge was powered by a dramatic rise in use of AI-driven shopping tools (traffic driven by those spiked 805% year-over-year), which helped buyers compare prices, find discounts, and complete purchases quickly. Even amid inflation, economic uncertainty, and tight household budgets, the American consumer can’t be stopped.

The good old days…when Black Friday was 50% shopping 50% UFC

2) Trump targets oil: Donald Trump is urging NATO countries to stop buying oil from Russia, warning that the U.S. is ready to impose new sanctions on Russia only if all NATO nations commit to halting Russian oil purchases. He argued that continued oil trade with Russia weakens NATO’s bargaining power and encourages Moscow’s war effort in Ukraine. Still, several NATO members - including Turkey, Hungary and Slovakia - remain buyers of Russian oil, complicating any unified action.

3) Databricks sky-high valuation: Databricks, the cloud software company, is reportedly in advanced talks to raise roughly $5 billion in new funding at a massive $134 billion valuation. The INSANE valuation represents about 32× expected 2025 revenue, underscoring how aggressively the market is pricing high-growth AI infrastructure. Despite the enthusiasm, Databricks has cautioned that their profitability has fallen because of heavy computing demands of AI workloads. AI bubble growing, shrinking, or popped?

Top WEIRD stories of the past week

1) Thieves stole €90,000 worth of high-quality snails meant for Michelin-starred restaurants from a French snail farm. Keep your eyes peeled for butter and garlic heists.

2) Offer Vince Shlomi - better known as the “ShamWow guy” from his infomercial days - has filed to run as a Republican for Congress in Texas’s 31st District. What a sham. Wow.

3) About 21% of peer reviews for a major AI conference were found to be entirely written by AI - prompting concerns over quality, fake citations, and whether humans are still really vetting published research. "AI is good!" - AI

Chart

You like charts? Graphs? Ya you do

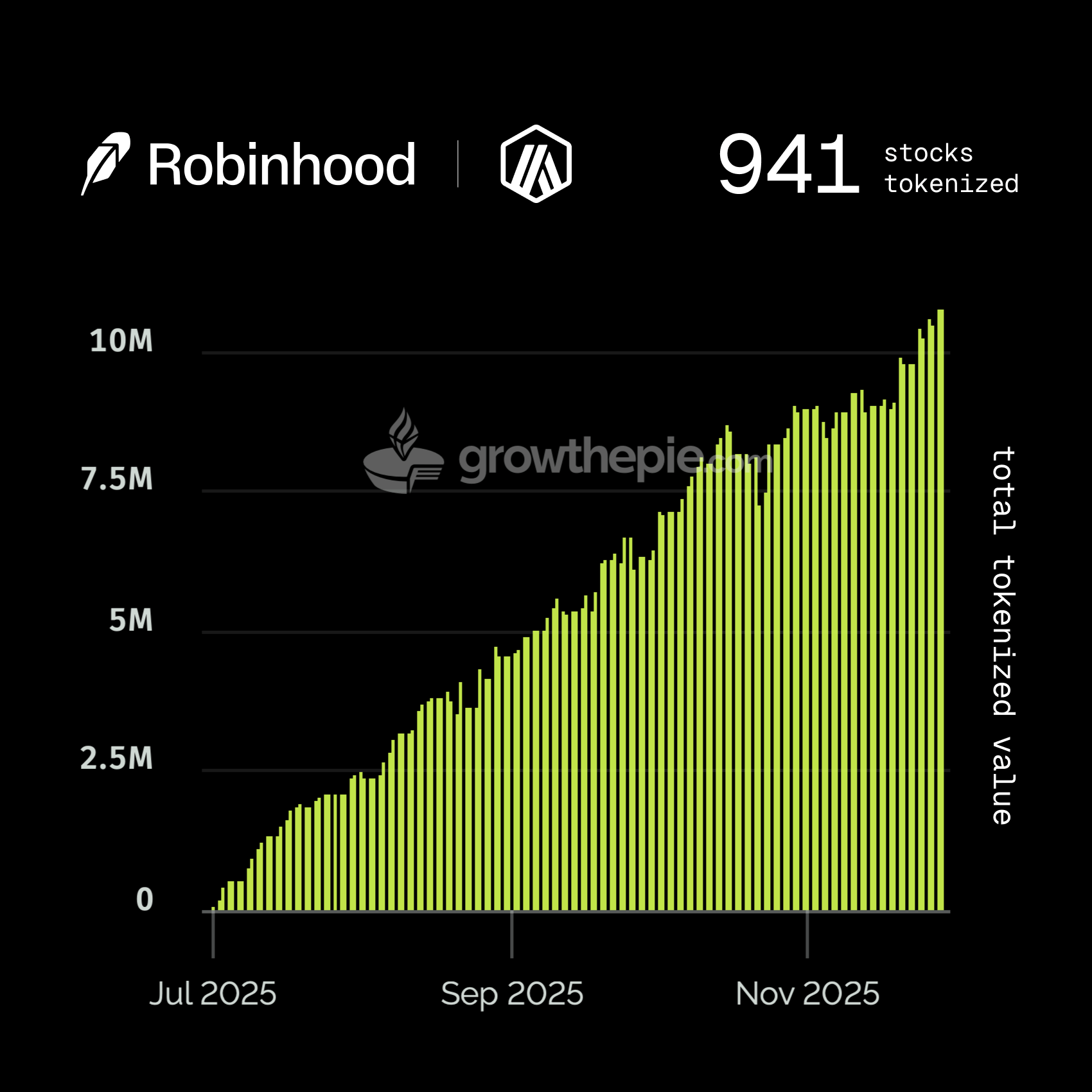

Robinhood is going all in on tokenization - using blockchain technology to make stocks easier, cheaper, and more secure to trade.

Personal Finance

Financial Booster

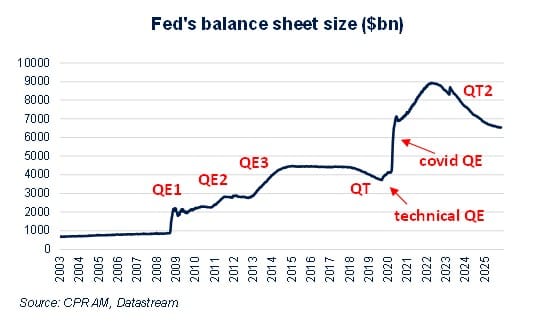

The U.S. Federal Reserve is about to stop quantitative tightening (QT).

But what’s quantitative tightening and why does this matter?

QT is when a central bank slowly takes money out of the financial system.

Taking money out of the financial system adds a ton of pressure on financial markets - less money moving around the financial system means less liquidity and more volatility.

When QT ends, liquidity improves. Banks have more reserves, and money markets stabilize. This shift often supports higher stock prices and lowers volatility, as investors gain confidence in easier financial conditions.

In the past, when central banks have paused or ended QT, stock markets have stabilized or bounced higher.

Let’s hope history repeats!

Music

Banger of the week

Most important thing

Meme? Nah. Art.