We all love "free" stuff. Free guac at Chipotle (if only), a free trial of another streaming service you’ll forget to cancel, and of course, "free" stock trading.

It’s amazing, right? Zero commissions. We’re all sticking it to the man, democratization of finance, yadda yadda yadda.

But you know that old saying... "If you’re not paying for the product, you are the product."

So, how exactly are apps like Robinhood throwing product launches in the South of France that look a James Bond movie? Magic? A really successful bake sale?

Spoiler: It’s not the bake sale.

This lavish event cost you nothing…right?

The "Free" Lunch That Isn't

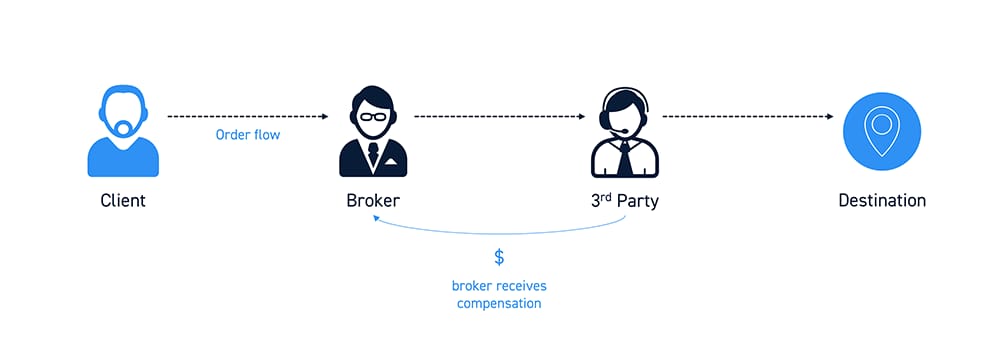

For many of these apps, the golden goose is Payment for Order Flow (PFOF).

That sounds painfully boring, so here's the 15-second version:

Imagine you tell your "free" broker app you want to buy a concert ticket (your stock). Instead of just getting it, the app walks your order over to a giant, back-room ticket scalper (a massive Wall Street firm). The giant firm pays your app a tiny kickback (the PFOF) and then sells you the ticket.

You got your trade. But your broker got paid.

"But... So What??"

"Who cares? It's a fraction of a cent!"

Here’s the catch: Your broker just got paid for the trade. Not for your good returns. For the trade.

This creates a massive conflict of interest.

The app's entire business model is now based on you trading as. much. as. possible.

And that is how "gamification" was born.

The confetti when you make a trade. The "Top Movers" lists. The notifications. The whole vibe is designed to feel less like investing and more like a casino. It’s all built to give you a dopamine hit and encourage you to pull the lever just... one... more... time.

The Real Cost of "Free"

"Okay, so they want me to trade more. I’m smart, I can resist!"

Maybe. But the data on this is... well, it’s not great.

Research shows that: The more a retail investor trades, the worse they perform. Full stop.

One of the most famous studies found that the most active traders had the worst performance. Their returns were more than a third lower than the people who just bought the market and... did nothing.

The investing myth, born from this research, is that the best-performing accounts at a brokerage were from people who were... dead. Video below of some successful investors being celebrated apparently.

(A close second: people who forgot their passwords.)

They won because they couldn’t panic-sell or FOMO-buy. They were physically prevented from making emotional, high-frequency trades.

So, is your "free" app really free if its design is scientifically proven to cost you a huge chunk of your potential returns?

Your Actionable Takeaway

Look, I'm not saying you need to delete your app. But this is a "know the game you're playing" situation.

This Week's Move: Separate your "toys" from your "tools."

Your Toys: Fine, keep the "free" app as your "Vegas" money. Put 1-5% of your investing cash in there. Go nuts. Have fun. See it for what it is.

Your Tools: Your real, future-millionaire, goal-oriented money? That belongs in a place built for long-term success, not short-term trades.

Stay curious (and a little skeptical).

P.S. What's the most "casino-like" feature you've seen on one of these apps? Hit reply. The weirdest one gets a virtual high-five.

P.P.S. If you want to chat more, find me here: Compound Club on Discord