Imagine it’s Sunday and you’re doing your weekly shop for the usual essentials:

Avocados

Beer

Lumber

Aluminum

Pork

A car

As you troll the aisles of Costco (doubling back with disguises to get seconds of each sample) you suddenly realize that everything is STUPID EXPENSIVE.

Well, brace yourself—prices might go even higher.

As you’ve probably heard, Trump says he’s bringing in a flurry of new tariffs. But what does that mean and how does it affect you?

Let’s get into it.

What are tariffs?

Tariffs are taxes or fees that governments charge on imported goods. Think of them as a toll for foreign products entering the country.

When a country imposes tariffs, it makes those imported goods more expensive. The idea is to encourage people to buy homegrown products instead of foreign ones. OR to encourage companies to start making their goods domestically instead.

Cars are a good example. The U.S. imports about $35 billion worth of cars from Canada each year. But could those manufacturers make the cars in the US instead? Technically, yes.

U.S. auto imports from Canada.

So tariffs encourage people to buy domestic goods and encourage companies to make stuff in the US. Sounds patriotic, right? But there’s a catch (we’ll get there).

Does the U.S. already use tariffs?

Big time. The U.S. already imposes tariffs on thousands of products. Some are small (think a few percentage points), while others are hefty.

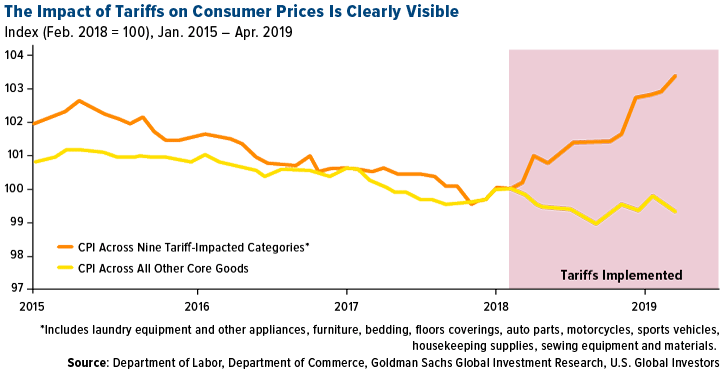

Remember when Trump launched a trade war with China during his first term? He slapped tariffs on over $360 billion worth of Chinese goods (quick guide on that here). From steel to washing machines, prices soared. And guess what? Many of those tariffs are actually still in place.

The new tariff plan

Trump’s latest plan takes things to a whole new level:

60% tariffs on goods from China.

25% tariffs on goods from Canada and Mexico.

20% tariffs on goods from every other country.

These are set to go into effect on February 1st.

If you’re thinking, “Wait, don’t we import a ton from Canada and Mexico?”—you’re absolutely right. And it’s not just cars and avocados.

How much does the U.S. import from Canada and Mexico?

A lot. In 2023:

The U.S. imported about $466 billion worth of goods from Canada.

It imported around $453 billion worth from Mexico.

We’re talking everything from cars to avocados to energy. Add a 25% tariff, and those prices are likely to skyrocket.

How tariffs hit your wallet

Let’s be real: tariffs sound like a punishment for other countries, but they actually hit you—the consumer—right in the bank account, especially in the short-term.

Here’s how:

Higher Prices for Everyday Goods

Tariffs make imports more expensive for U.S. companies, and those costs get passed on to us. Think pricier groceries, electronics, and cars.Fewer Choices

If companies can’t afford to import certain products, they might just stop offering them. Less competition usually means higher prices.Retaliation from Other Countries

If the U.S. imposes tariffs, other countries often retaliate. That means American products sold abroad could face higher taxes, hurting U.S. businesses that rely on exports.

So, what’s the goal here?

Trump argues that tariffs protect American jobs by making U.S.-made products more competitive. But economists often disagree.

In the past, tariffs have caused:

Job losses in industries that rely on imported materials (things like electronics).

Higher costs for American manufacturers and consumers alike.

It’s like trying to help a farmer by raising the price of fertilizer—they might sell more corn, but they’re spending way more to grow it.

The bottom line

If these tariffs go into effect, your wallet’s going to feel it—whether you’re buying fresh fruit, a new car, or just trying to keep the lights on.

What can you do? Pay attention to where your money is going. Maybe stock up on a few essentials now, before prices rise.

Different executive order, equally important.